Initial and Periodic Mass Copy

Pre-Requisites:

- Corporate Book and Tax Book needs to be setup

- Asset Categories needs to be set for Tax Book

- Its desirable to complete the transactions in Corp Book, Run Depreciation, Close the Corp Book and then run Periodic Mass Copy

|| Mass Copy ||

- For the first period, run Initial Mass Copy program

- For Subsequent periods, run periodic Mass Copy program

|| Initial Mass Copy ||

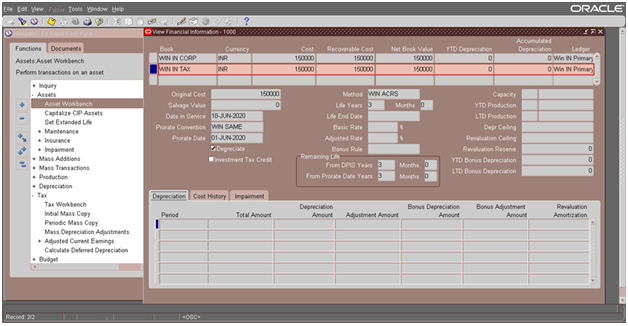

- Initial Mass Copy program copies all the assets added under corporate book and Tax Book

- We can run it as many times as necessary for the first period to copy all existing assets. When you rerun the process, Initial Mass Copy only looks at the assets which it did not copy into the Tax book during previous attempts, so no data is duplicated.

- It Copies the below basic information for Corp book to Tax Book:Cost, Units, DPIS, Salvage Value, etc.

Note: Depreciation Method,

Life of the asset etc. comes from the default values assigned under asset

categories

|| Periodic Mass Copy ||

Addition, Adjustment, Retirement and Re-instatement

1. Setup Corp Book and Tax Book

2. Create Asset in Corp Book

3. Run Periodic Mass Copy

Scenarios

where periodic mass copy do not copy from Corp Book to Tax Book:

- Asset category is not setup in Tax Book

- If you perform any Cost Adjustment directly in Tax Book, then subsequent cost adjustment for those do not get copied for Corp to Tax Book

4. Query and check whether assets are transferred to Tax Book

Content writer- Araf Shaikh